- AWS›

- Solutions›

- Case Studies›

- AWS Innovators

Capital One on AWS

Capital One has been a disruptor in the financial services industry since 1994, using technology to transform banking and payments.

Capital One strengthens its technology resilience using AWS

In its journey to build a technology company, Capital One wanted to transform its approach to resilience. Working closely alongside the AWS team, the company developed innovative solutions to improve reliability and strengthen its systems.

Capital One's cloud journey

Capital One unlocks innovation with observability and governance on AWS

Capital One ensures strong governance and enhances visibility and observability at scale. The move to AWS Cloud Operations has enabled rapid innovation, faster infrastructure provisioning, and real-time access to cutting-edge services that support advanced AI and ML. Together with AWS, Capital One is delivering secure, reliable, and innovative digital experiences to its customers.

Capital One improves cloud resilience using AWS

Ed Peters, distinguished engineer at Capital One, explains how Capital One improved the resilience posture of its applications. By intelligently leveraging the AWS global infrastructure and using AWS services like Amazon Route 53 and Amazon CloudWatch, Capital One inspected and improved its failover mechanism to ensure its banking applications stay up and available when needed.

Capital One processes checks 80% faster using AWS Step Functions

Capital One used AWS Step Functions—a visual workflow service for distributed applications—to expedite its check-clearing application. By optimizing AWS Step Functions, Capital One reduced processing time by up to 80 percent and greatly improved analyst productivity.

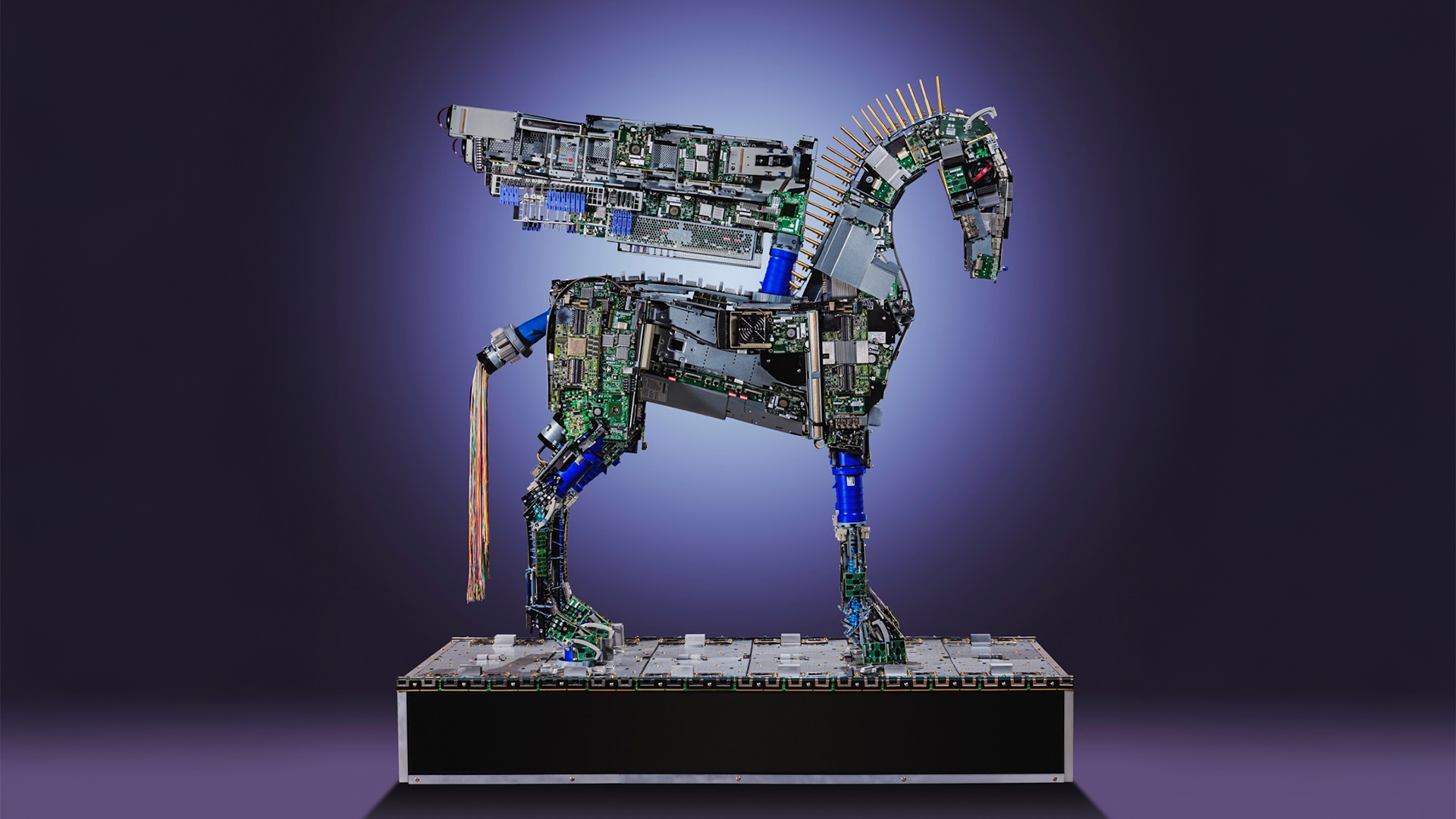

Capital One brings sustainability to its cloud migration

When Capital One decided to move to the cloud, it established a plan for responsibly disposing of its data center equipment. During migration, the company recycled 41 tons of copper and 62 tons of steel, and removed 13.5 million feet of cable from its last three data centers. Capital One expects to save 10 megawatts of power annually by exiting its data centers, equivalent to the power used by 650,000 LED light bulbs.

Capital One enhances fraud protection using AWS machine learning

As consumers continue to forgo brick-and-mortar banking for digital-first services, Capital One has embraced new technologies, adopting and applying AWS-backed AI and ML solutions to nearly every facet of the business and infusing the customer experience with intelligence. Because AWS is just as secure—and often more secure—than on-premises data centers, Capital One applies these innovations while upholding its responsibility to protect customers and their data.

Capital One at re:Invent

Capital One builds the future of cloud operations at any scale

Capital One architects modern apps for observability and resilience

Creating remote work Capital One creates remote work environments that optimize security and productivity that optimize security, productivity

Capital One implements proactive governance and compliance for AWS workloads

Capital One shares practical experience with a serverless-first strategy

Capital One accelerates innovation with AWS databases

We have successfully exited all of our data centers and gone all in on AWS, enabling instant provisioning of architecture and rapid innovation. We are now able to manage data at a much larger scale and unlock the power of machine learning to deliver enhanced customer experiences. On AWS, our technology teams are freed to focus on what they do best: building great software and delivering innovation to our customers.

Rob Alexander

Chief Information Officer, Capital OneAbout Capital One

Founded in 1994, financial services company Capital One provides credit cards, checking accounts, savings accounts, auto loans, and more to more than 100 million customers.

More customer stories

Did you find what you were looking for today?

Let us know so we can improve the quality of the content on our pages