Agentic AI Reshapes Investment Research: MaxQuant Users Streamline Heavy Workloads

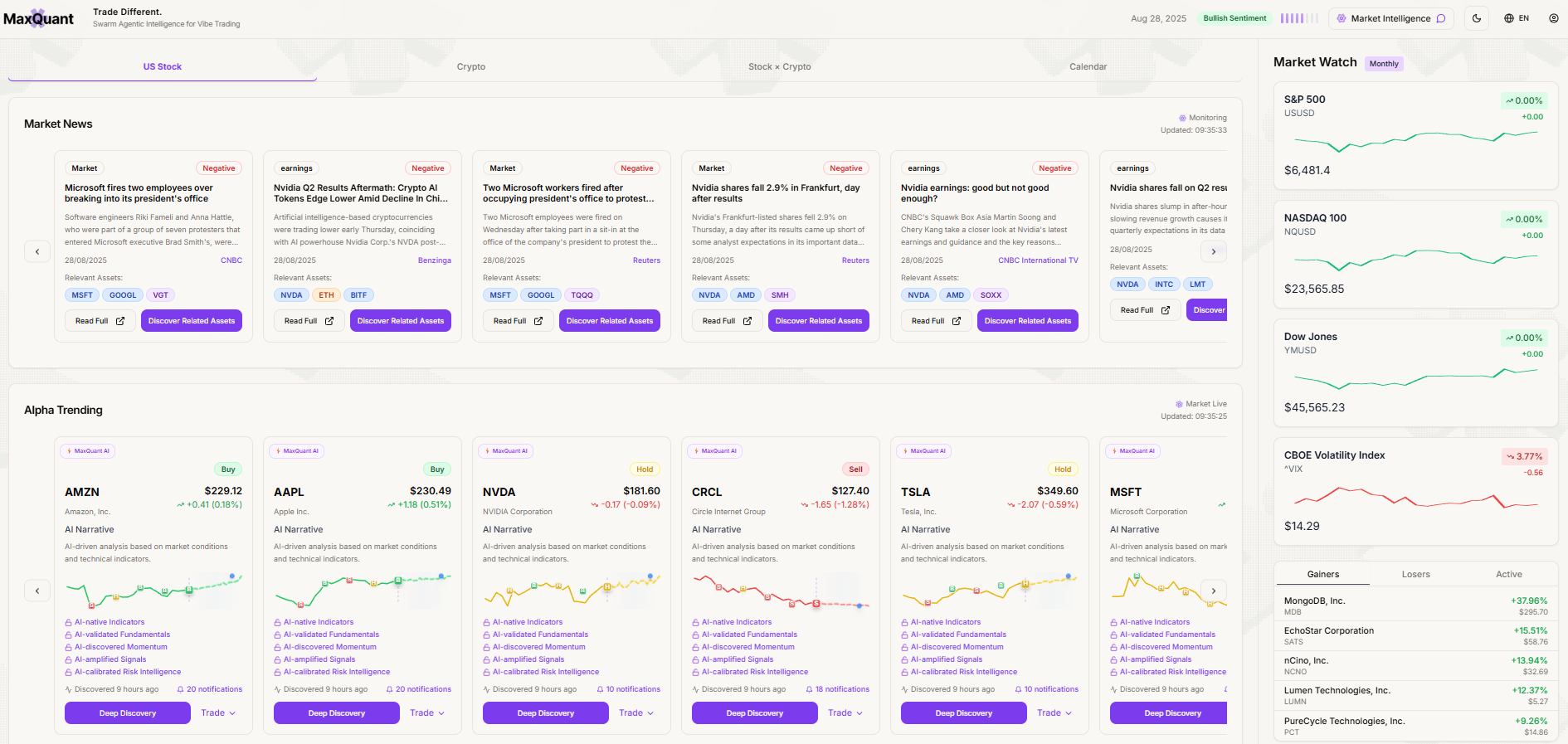

MaxQuant is an AI infrastructure platform for financial data analysis. By leveraging Amazon Bedrock AgentCore, MaxQuant has shortened the deployment cycle of its investment advisory assistant, an AI agent-based core module, from 4 weeks to 1 week. This accelerates strategy innovation for quantitative trading institutions and individuals, enhancing user experience.

Benefits

Overview

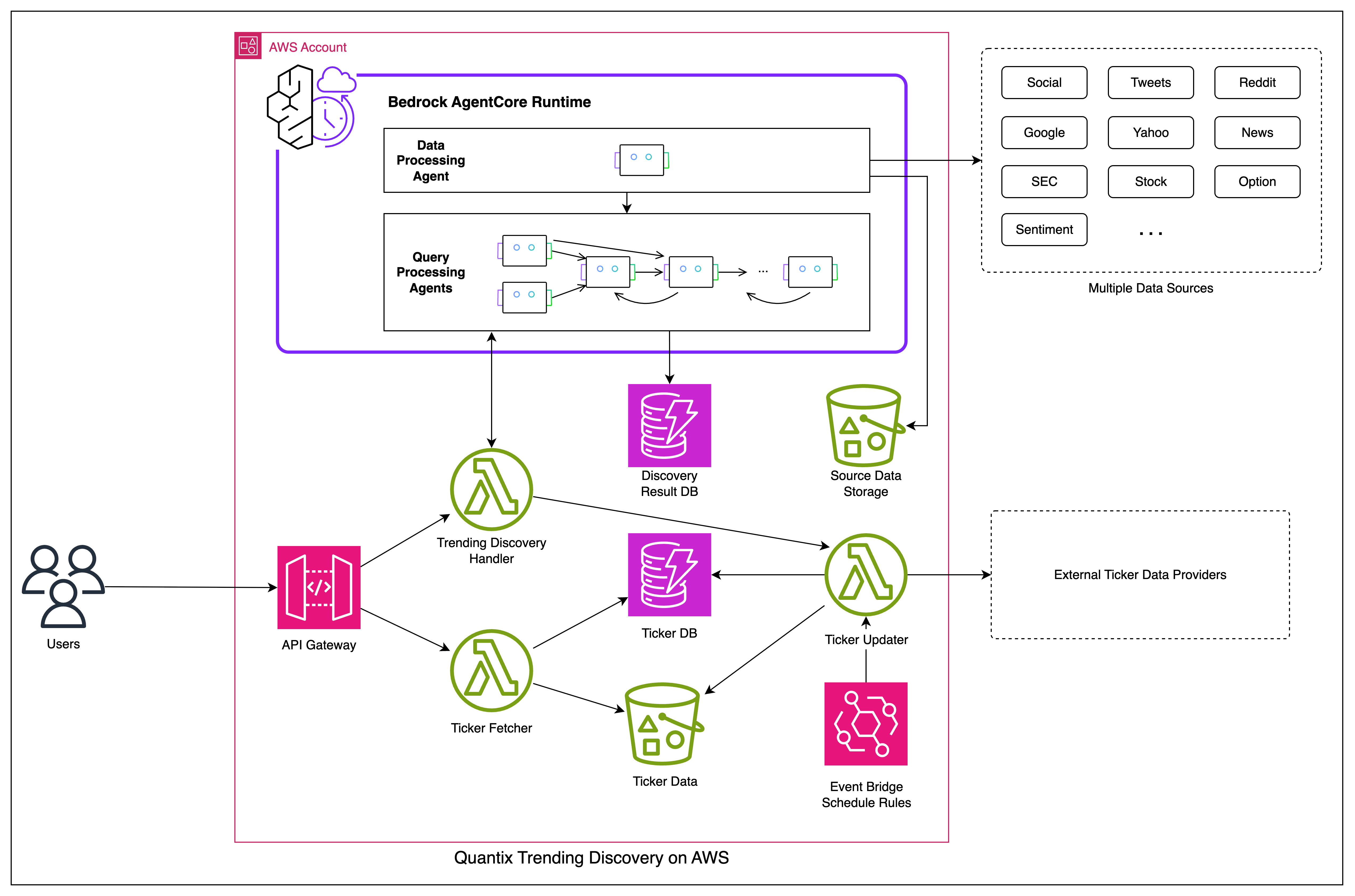

MaxQuant, an AI infrastructure platform for the finance sector, is committed to building next-generation, intelligent investment research and trading decision-making systems to reshape investment operations, implementing AI-powered decision-making. Amazon Bedrock AgentCore enables MaxQuant to efficiently implement multi-agent orchestration and build applications, reducing the deployment cycle of its core module — the investment advisory assistant — from 4 weeks to 1 week. This accelerates strategy innovation for quantitative trading institutions and investors, revolutionizing user experience. MaxQuant uses multiple AWS products and solutions, including Amazon Bedrock AgentCore, Amazon Lambda, Amazon EventBridge, Amazon DynamoDB, and Amazon API Gateway.

Opportunity

Agentic AI Improves Transparency in Financial Trading

High entry barriers, low transparency, and limited asset coverage often constrain traditional financial trading. Individual investors and beginners must possess coding and data engineering skills for implementing strategy design and execution. Moreover, even seasoned investors may deviate from optimal decisions when interpreting complex news and market signals due to information asymmetry. MaxQuant views these structural issues as reducing trading opportunities, restricting creativity and capping profit potential.

To address these issues, MaxQuant turns to agentic AI to bridge trading asymmetries, explore more open and efficient quantitative trading models, and expand financial inclusion with services accessible to ordinary users. However, agentic AI often operates in fragmented environments. Different agents run with distinct contexts, dependencies, and invocation protocols. Building such a system from scratch would require significant time and resources for orchestration, fault tolerance, and monitoring. In addition, financial trading is inherently volatile. Systems must scale during peak hours while satisfying strict compliance and auditability requirements specific to financial scenarios, posing substantial architectural challenges.

Most critically, the market lacks an agentic AI infrastructure purpose-built for financial trading. Many existing solutions focus on models while neglecting engineering scalability, or provide insufficient compute resources for multi-agent orchestration and execution. In addition, agentic AI infrastructure evolves rapidly. For an early-stage firm like MaxQuant, investing heavily in building, upgrading, and maintaining foundational environments would require significant dedicated resources. This would inevitably slow product iteration and prevent MaxQuant from standing out in the rapidly evolving competitive environment. To stay ahead, MaxQuant urgently needs elastic and compliant agentic AI infrastructure to support multi-agent operations efficiently.

Since the launch of Amazon Bedrock, MaxQuant has closely followed its development and updates. At AWS Summit New York 2025, Amazon Bedrock AgentCore was officially announced. MaxQuant immediately recognized that AgentCore's runtime capabilities could integrate seamlessly with its existing products and services, addressing engineering challenges such as multi-agent orchestration and unified context management. What's more, the elasticity and compliance capabilities of AWS services meet the requirements of MaxQuant for financial trading. After consultations with AWS architects and engineers,

MaxQuant decided to migrate all workloads to AWS to build a next-generation, agentic AI-driven platform for investment research and trading decision making.

Solution

End-to-End Support from Technical Foundation to Collaborative Functional Expansion, Accelerating Startup Growth

Amazon Bedrock AgentCore Enables Developers to Focus on Innovation

Amazon Bedrock AgentCore provides a complete set of capabilities to deploy and efficiently run AI agents. It helps developers bridge the critical gap between proof of concept and production deployment, enabling the rapid, secure, and large-scale deployment and operation of AI agents. Amazon Bedrock AgentCore now provides seven core capabilities for AI agents, including runtime, memory, identity verification, gateway, code interpreter, browser tools, and observability dashboards.

In its quantitative trading system, MaxQuant first experimented with Amazon Bedrock AgentCore's runtime capabilities for basic tasks such as data parsing and strategy backtesting. Compared with traditional architectures, you do not need to maintain the underlying runtime environment when you use Amazon Bedrock AgentCore. Amazon Bedrock AgentCore offers greater flexibility to meet compute demands in high-frequency trading scenarios. As the collaboration deepened, MaxQuant progressively migrated more complex workloads onto other AgentCore modules, such as generating fine-grained customer profiles before trades or automatically optimizing multi-strategy portfolios during trades. With agentic AI for collaborative task execution like data ingestion, feature extraction, model invocation, and strategy evaluation, an automated loop from analysis to execution is built. This allows R&D efforts to focus on strategy development and user experience improvement. Furthermore, the developer team no longer needs to orchestrate AI agents when new agents are added. System maintainability and scalability have been greatly improved.

Decoupling Heavy and Light Tasks for Greater Agility

Besides using Amazon Bedrock AgentCore to handle complex multi-step reasoning and strategy optimization, MaxQuant also encapsulated lightweight logic — such as cache refresh, batch data cleanup, log processing, and state synchronization — into Amazon Lambda functions, triggered through Amazon EventBridge. This approach, which decouples heavy and light tasks, enables MaxQuant to focus on high-value business processing and better unlock the value of agentic AI.

MaxQuant leverages Amazon EventBridge to flexibly capture events from different systems and trigger the corresponding Amazon Lambda functions, implementing cross-module automation. Built on an event-driven architecture, Amazon Lambda provides inherent elasticity and isolation, scaling for lightweight tasks on demand in high concurrency conditions without blocking core workflows. From an extensibility perspective, when new features are required, the developer team only needs to add functions that can seamlessly integrate into existing workflows. This "change once, apply globally" approach significantly reduces O&M overhead and enhances overall system agility.

Technology, Resources, and Expansion Driving Growth

As a young startup, MaxQuant has benefited from AWS not only through the "AgentCore × Serverless × Event-driven Architecture" technology stack, but also through critical support along its growth journey:

- Technology: The AWS Solutions Architect team provided ongoing guidance, helping MaxQuant avoid early risks while integrating Amazon Bedrock AgentCore with a serverless, event-driven architecture. This allowed the developer team to stay focused on quantitative trading business logic and product experience.

- Resources: Through the AWS Startups Program, MaxQuant received valuable cloud resource quotas, accelerating experimentation and product iteration.

- Expansion: AWS offers a platform for MaxQuant to connect with potential partners, provides clear pathways and guidance for listing on AWS Marketplace, and presents MaxQuant opportunities to engage a broader base of prospective customers and investors, thereby expanding MaxQuant’s market reach.

With AWS's global compliance and infrastructure footprint, MaxQuant is able to win customer trust during international expansion by lowering technical barriers and demonstrating its strong professionalism. These AWS supports not only enable MaxQuant to build technical stability and credibility in early stages but also create a virtuous cycle between R&D and business growth, accelerating its overall growth.

We are honored to have been selected for this year's AWS Startup Program. This program has opened up new opportunities for potential funding and helped raise greater awareness of MaxQuant.

Zeng Jingfeng

CEO, MaxQuant

After adopting Amazon Bedrock AgentCore, we no longer need to rewrite task-triggering logic. By simply declaring relationships and context-passing strategies, we can orchestrate agent applications while avoiding repetitive 'reinventing the wheel' work. This allows us to focus more on use case and functional expansion.

Zhang Weitong

Chief Scientist, MaxQuant

Different agents have varied runtime environments and configurations, resulting in high integration and deployment costs. As a financial product, MaxQuant requires strict standards for data processing, security control, and auditability. Amazon Bedrock AgentCore not only provides comprehensive agentic AI application development capabilities but also meets our business requirements for system stability, security compliance, and scalability.

Zeng Jingfeng

CEO, MaxQuant

In financial scenarios, runtime support for individual agents in multi-agent systems remains limited. With Amazon Bedrock AgentCore's runtime capabilities, we have taken the first step in this area, allowing us to quickly integrate AI agents into our existing business framework and build next-generation, differentiated AI agents.

Zhang Weitong

Chief Scientist, MaxQuantOutcome

Amazon Bedrock AgentCore Accelerates MaxQuant's Quantitative Trading Solution Deployment

With Amazon Bedrock AgentCore and other AWS services, MaxQuant reduced the development cycle of its core business modules from 4 weeks to 1 week, and the overall development was completed in just 1 month, well ahead of the 12-month estimate. The new system delivers efficient capabilities for data parsing, strategy backtesting, customer profiling, and strategy portfolio optimization in quantitative trading.

Beyond accelerating development, AI adoption lowers costs: Using Amazon Bedrock AgentCore reduces the MaxQuant team from 8–10 to 2–3 members, saving USD 3 million in human resource costs. By adopting the pay-as-you-go billing mode, MaxQuant avoids GPU hardware investments and cuts infrastructure costs by 80%.

By leveraging AWS's industry-leading security and compliance practices, MaxQuant improved R&D and delivery efficiency, significantly reduced costs, and also reinforced security and trust in the financial sector. At a recent MaxQuant community gathering in London, numerous quantitative traders and strategists expressed strong interest in the system, further proving the system's technical breakthrough and significant value.

While gaining recognition, MaxQuant has also shared its perspective on the future of multi-agent applications in financial scenarios. Zhang Weitong noted: "Agentic Trader will be among the first agents capable of fully autonomous operation, delivering execution efficiency, coverage, and speed beyond human capacity. It will enable seamless collaborations across borders, institutions, and asset classes. Humans, in turn, will be freed from repetitive tasks, instead focusing on defining values and providing governance oversight. What MaxQuant validates is not only the return potential of agentic AI-powered trading strategies, but also the resilience and autonomy of agents to operate in complex

social systems and meet real-time compliance requirements. We look forward to partnering with like-minded organizations such as AWS to usher in a new era of financial intelligence."

Looking ahead, MaxQuant hopes to continue working with AWS to further deepen the application of AgentCore and explore differentiated paths for multi-agent systems in financial scenarios. Building on single-marker analysis, MaxQuant aims to introduce agentic AI to cross-asset portfolio and hedging management covering stocks, options, and digital assets such as real-world assets (RWAs). This marks the next step toward its vision of "building a one-stop quantitative trading system with AI agents."

About MaxQuant

MaxQuant is the world's first AI infrastructure platform designed for financial markets. It is committed to building next-generation, intelligent investment research and trading decision-making systems to reshape investment operations, implementing AI-powered decision-making.

AWS Services Used

Disclaimer: Amazon Web Services currently deploys the aforementioned certain generative AI-related services in Global regions. Amazon Web Services China region services are operated by NWCD and Sinnet, with more details at the official Amazon Web Services China region website.