How was this content?

Alloy’s global identity decisioning platform, built on AWS

Entrepreneurs know all about risk versus reward: short-term trade-offs, long-term gains, and some decisions so complex that solving one conflict raises another. This is particularly true in the financial industry, where success is built on choosing the right clients.

Alloy co-founders Laura Spiekerman (president), Tommy Nicolas (chief executive officer CEO), and Charles Hearn (chief technology officer CTO), saw these challenges as a business opportunity.

In 2015 they founded Alloy, a unicorn fintech startup whose global identity decisioning platform helps banks and fintech companies automate their decisions for onboarding, transaction monitoring, and credit underwriting.

Alloy combines the use of traditional data sources (such as credit scores) with newer, alternative data sources, such as cash flow data, to provide a complete and more accurate picture of each customer.

“We tell you which aspects of a client’s identity match, and which don’t match, or match in one record source but not another, and here’s an interesting flag that we should show you,” explains Charles.

Effective identity decisioning helps companies to:

- Minimize financial risk

- Maximize information security to avoid fraud

- Pave a path to smooth and seamless client onboarding

Working backwards from the problem

With experience in startups and payments processing, the trio of co-founders is well-versed in the identity verification problem. Alloy is built from their collective experience, determination, and—as the founders readily admit—a fair bit of luck.

At the payment processing startup where Laura, Charles, and Tommy met, “We saw firsthand that the answer [to identity decisioning] was for each company to make relationships with data vendors and then have engineers integrate them. It wasn’t core to the business, but it was the thing you had to build,” says Charles. “Businesses were losing time and resources by building the identity-decisioning infrastructure instead of incorporating a ready-made solution.”

Laura, Charles, and Tommy saw the opportunity to create a better solution for companies whose success was dependent on choosing the right clients. They left the payments processing company and founded Alloy.

In the beginning, explains Laura, “Charles was building the product with a couple of engineers, I was having conversations with prospects and customers, and Tommy was implementing the solution and getting product feedback.”

Today, their API-based platform services over 300 banking and fintech clients.

Providing a singular solution

What sets Alloy apart? Quite a lot, actually.

For starters, Alloy clients have the power to make informed decisions.

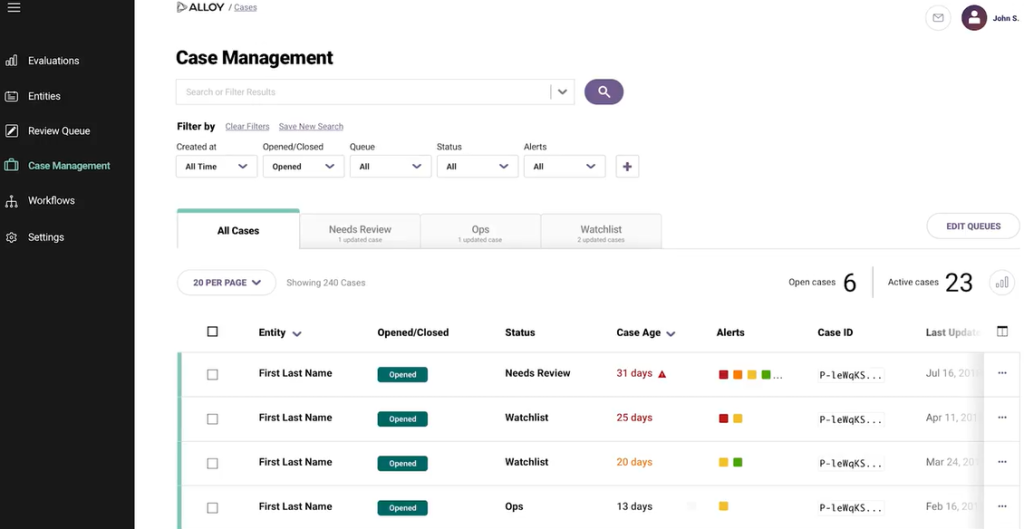

Transparency into the data within the Alloy platform allows clients to tweak their risk tolerances to determine who to approve or deny. Clients can set mutually dependent parameters of who to flag, all without ever touching a line of code.

The specificity of what you can flag and let through helps Alloy serve a broad range of clients. For instance, a credit card company has a different risk tolerance than a bank or a bitcoin company.

Clients can use these features to instantaneously onboard customers who may have otherwise been sent to manual review or declined due to a lack of data or a mismatch between the data and the risks.

“Our product lets you see the outcomes,” explains Laura, “so you can easily see how you’re optimizing for fraud mitigation or for conversion. We give you the results and you can spot where your performance is the best.”

Creating broader access to financial services, while making it safe and easy for the companies involved, is a core component of Alloy's mission. “We have always taken our position in approving and denying people for essential financial services really seriously,” explains Charles. “The core motivation behind our product is to make those experiences safe and easy to do.”

Building on AWS

One way Alloy is giving their customers an easy-to-use experience is by building a cloud-native product. Charles laughs as he recalls how, in 2015, “I got a lot of questions from our initial clients about, ‘Can you build financial infrastructure on the cloud?’ Today it’s obvious that you can, but at the time only a few companies were doing it.”

For their cloud technology, Alloy is all-in on AWS. Whether that be their core PostgreSQL database that runs on Amazon Aurora; their compute, which runs their containerized applications on Amazon Elastic Kubernetes Service (EKS); or Amazon OpenSearch Service, which Alloy relies on for log analytics and search. Beyond these fundamental technological components, the Alloy teams also use Amazon ElastiCache for their caching needs and Amazon Managed Workflows for Apache Airflow (Amazon MWAA) to orchestrate their data pipelines. They also use AWS machine learning and analytics services to enhance their decisioning and monitoring services.

“We joined very early with AWS. A lot of the products AWS offered made us stand out and made it easier for us to get off the ground, especially for providing security,” says Charles.

Alloy joined the AWS Activate startup program through Techstars which, “was essential to our growth in our first two years,” said Charles. “Through the program, we didn’t have to pay for server costs for a long time and AWS provided an experienced solutions architect to streamline our infrastructure in those earliest days.”

“Using AWS services makes it easier to optimize building your product instead of building all of the things that you think you have to build that are peripheral to it,” says Charles. “That’s the same thing we try to do for our clients—take things off their plate, and handle the things that are not core to their business, so they can focus on their core business objectives.”

Strong collaboration, proactiveness, and openness between Alloy and their AWS account team has led to more effective solution implementation, accelerated progress on key initiatives, and support for launching new products. “AWS is always helping us assess how to optimize our tech stack, especially as we’ve launched new products like transaction monitoring, which required different scalability requirements than our original onboarding product,” explains Charles.

With opportunities for on-site solution immersion days, product team engagement, solution brainstorming sessions, and strategic sessions to work backwards from a customer goal, it is easy to see how leaning into a relationship with AWS can accelerate startup success.

Going broader and going global

What’s next for this fintech unicorn?

To make financial experiences even more safe and seamless, Alloy expanded its solutions to include transaction monitoring and credit underwriting in 2021.

“We’re creating a unified view of the customer lifecycle: we plug our onboarding system into our transaction monitoring system and our credit underwriting system. This will allow our clients to make more intelligent identity and risk decisions about the customer,” explains Charles. Creating a system of products that talk to each other and feed off of each other’s information will be much more powerful than analyzing smaller pieces of customer information in a vacuum.

Along with broadening their product range, in August of 2022 Alloy expanded internationally. Per Charles, “In part, we’re able to do this because AWS allows us to easily create a data center in Ireland. We’re also creating one in Australia, to more easily serve clients around the world.” To date, clients in 40 countries can access Alloy’s services and they expect the number to grow.

“We’ve seen through the first two or three innings,” says Laura. “We still have a lot more to go.”

Charles Hearn

Charles Hearn, listed on the Forbes 30 Under 30 list in 2020, is a cofounder and the CTO at Alloy. Previously, Charles was a project manager at Microsoft and the lead developer at a high-risk payment processing company.

Laura Spiekerman

Laura Spiekerman, recognized by Crain’s New York in 2021 as a Notable Woman on Wall Street, is a cofounder and President at Alloy. Prior to Alloy, Laura led Business Development & Partnerships at an ACH payments startup and was on the Research & Investment team at Imprint Capital Advisors (acquired by Goldman Sachs). Laura is a proud Barnard College alumna and lives in Berkeley, California.

Megan Crowley

Megan Crowley is a Senior Technical Writer on the Startup Content Team at AWS. With an earlier career as a high school English teacher, she is driven by a relentless enthusiasm for contributing to content that is equal parts educational and inspirational. Sharing startups’ stories with the world is the most rewarding part of her role at AWS. In her spare time, Megan can be found woodworking, in the garden, and at antique markets.

How was this content?