Overview

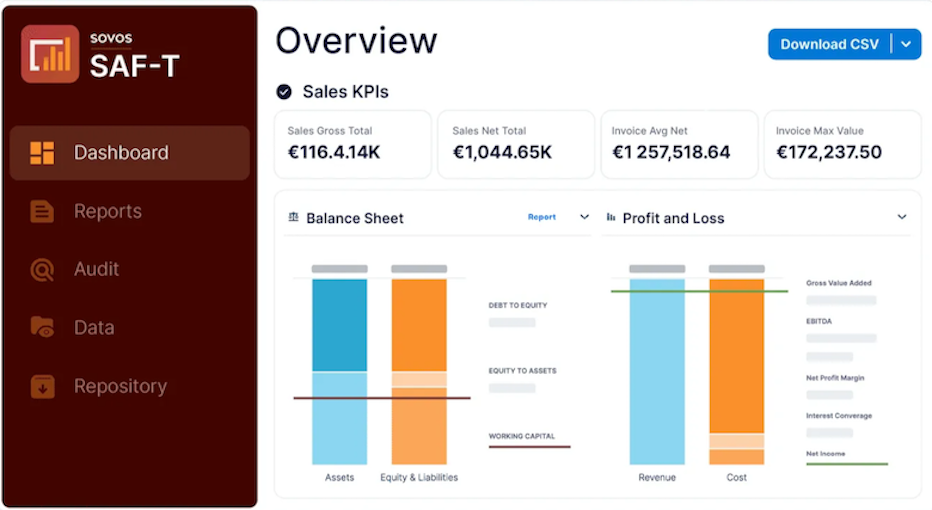

Sovos SAF-T Dashboard Overview

Dashboard showing real-time sales, balance sheet, and profit-and-loss data, providing audit-ready financial insights for SAF-T and eAccounting compliance.

Sovos SAF-T Dashboard Overview

SAF-T Analytics Dashboard Overview

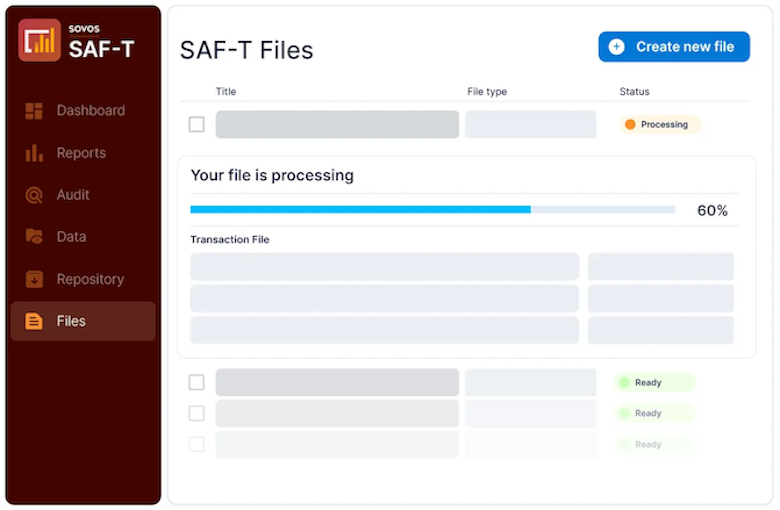

Sovos SAF-T File Management Screen

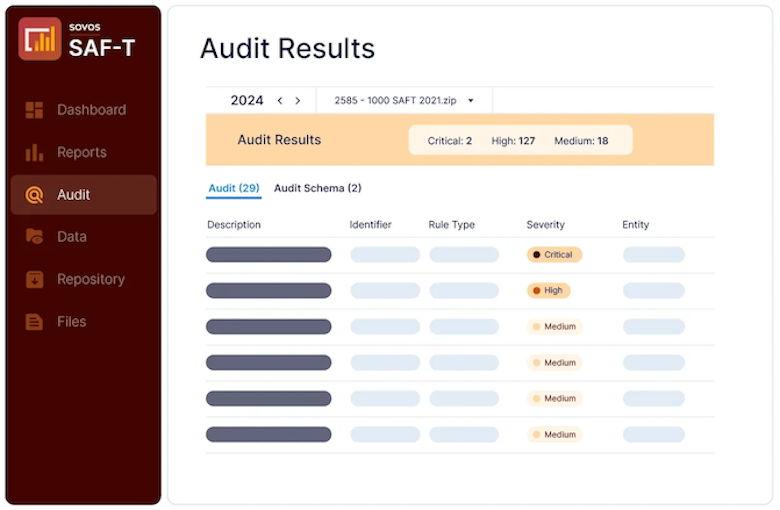

Sovos SAF-T Audit Results Dashboard

Sovos eAccounting and SAF-T compliance delivers end-to-end automation for extracting, validating, and generating standardized accounting data files required under OECD SAF-T and national eAccounting regulations. The solution integrates directly with major ERP systems to automatically pull general ledger, accounts receivable/payable, inventory, and fixed-asset data without interrupting daily operations.

After extraction, Sovos validates the completeness and accuracy of the data, identifying missing fields, inconsistencies, or format errors before submission. Each file is tailored to country-specific SAF-T or eAccounting schema requirements, ensuring compliant reporting for jurisdictions such as Norway, Poland, Portugal, Lithuania, and France. This helps organizations reduce manual effort, maintain data quality, and avoid penalties or audit findings.

Sovos eAccounting and SAF-T compliance provides centralized reporting, configurable analytics, and audit-ready outputs to give organizations clearer visibility into their financial data. Running on AWS, the solution scales easily as reporting mandates evolve and data volumes grow, supporting global enterprises with reliable, consistent, and secure compliance capabilities.

Highlights

- Automated SAF-T & eAccounting Compliance: Automates the extraction, validation, and generation of country-specific SAF-T and eAccounting files, ensuring accurate and compliant reporting for multiple jurisdictions.

- Seamless ERP Integration: Connects directly to ERP systems, such as SAP, Oracle, and others, to retrieve financial and transactional data in real time, reducing manual data collection and improving reporting consistency.

- Audit-Ready Reporting & Insights: Delivers validated, audit-ready files along with trend visibility and compliance insights to help organizations strengthen controls and reduce tax-audit risk."

Details

Introducing multi-product solutions

You can now purchase comprehensive solutions tailored to use cases and industries.

Features and programs

Financing for AWS Marketplace purchases

Pricing

Dimension | Description | Cost/12 months |

|---|---|---|

Transaction Subscription | Annual subscription for Sovos VAT SAF-T & eAccounting, enabling extraction, generation, and validation of transactional data for regulatory compliance. Pricing varies by transaction volume; the listed price reflects the starting tier for up to 1.2M transactions annually. | $4,200.00 |

Additional Tax IDs | Extend VAT SAF-T & eAccounting coverage with additional tax IDs. Pricing varies by number of IDs; listed price reflects starting tier. | $1,500.00 |

Long Term Archiving | Supports long-term digital storage of VAT SAF-T & eAccounting records. Pricing varies by document volume; the listed price reflects the starting tier for up to 1.2M records annually. | $420.00 |

Vendor refund policy

Payments for Sovos VAT, SAF-T, and E-Accounting products are non-refundable unless otherwise specified in the applicable order or agreement.

Custom pricing options

How can we make this page better?

Legal

Vendor terms and conditions

Content disclaimer

Delivery details

Software as a Service (SaaS)

SaaS delivers cloud-based software applications directly to customers over the internet. You can access these applications through a subscription model. You will pay recurring monthly usage fees through your AWS bill, while AWS handles deployment and infrastructure management, ensuring scalability, reliability, and seamless integration with other AWS services.

Resources

Vendor resources

Support

Vendor support

Sovos is dedicated to providing exceptional service to each of our customers. Our commitment has earned Sovos recognition as a trusted, long-term partner rather than just a software provider. To ensure top-tier support, our teams specialize in specific solutions, offering expertise tailored to your needs. https://sovos.com/support/

AWS infrastructure support

AWS Support is a one-on-one, fast-response support channel that is staffed 24x7x365 with experienced and technical support engineers. The service helps customers of all sizes and technical abilities to successfully utilize the products and features provided by Amazon Web Services.

Similar products