Overview

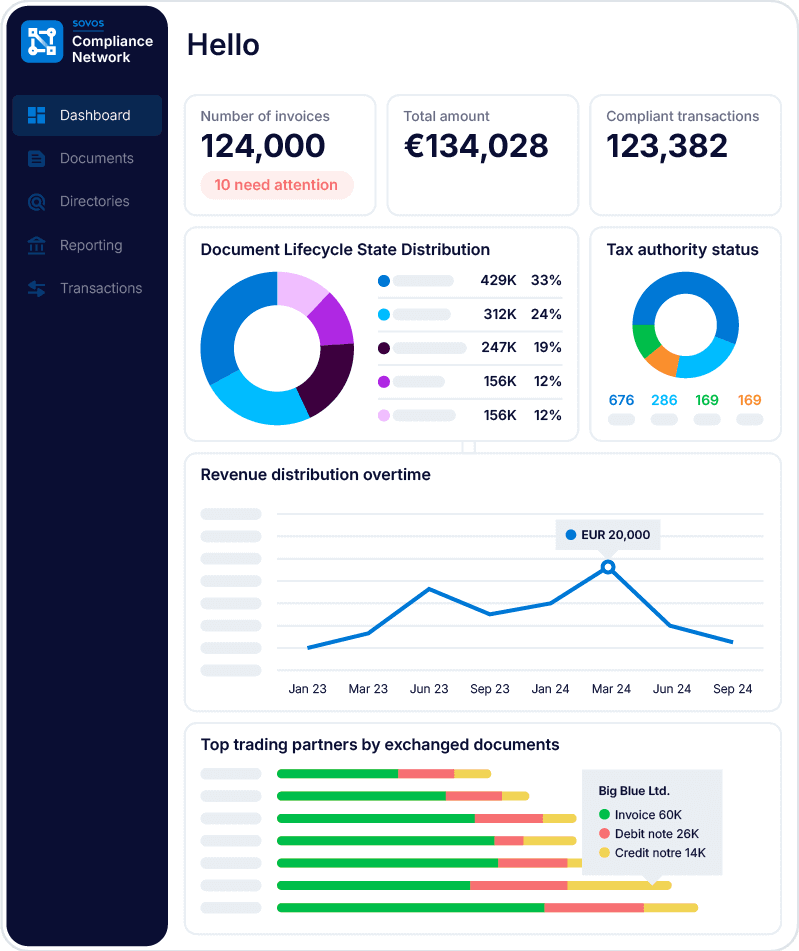

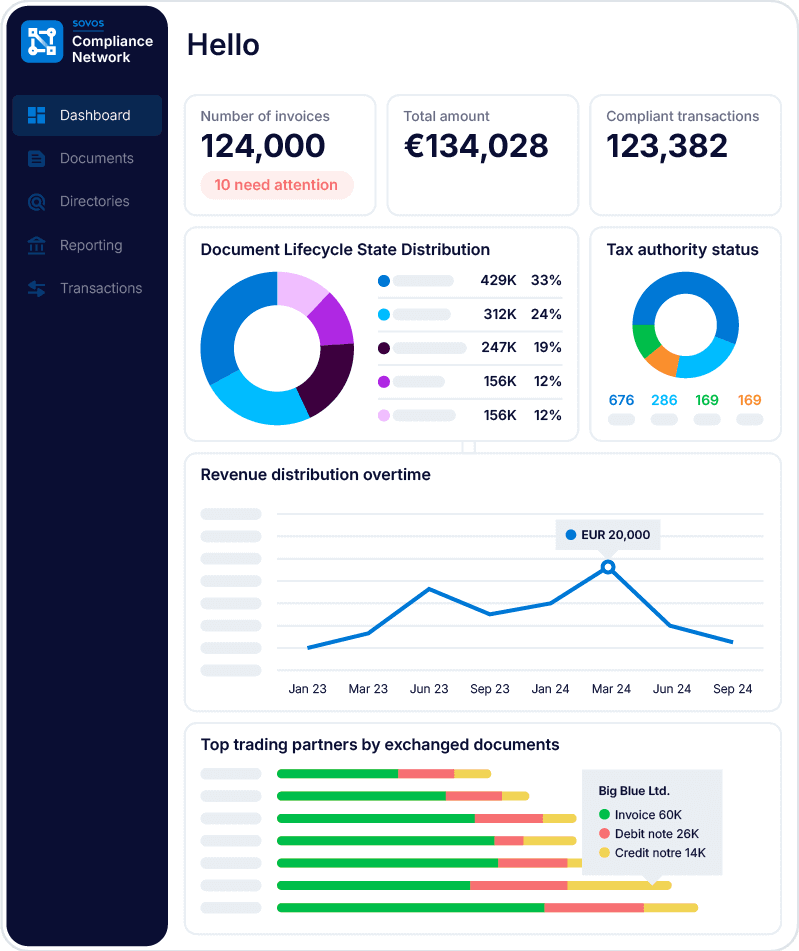

Compliance Network Dashboard

Real-time compliance dashboard showing invoice processing, document lifecycle states, tax authority status tracking, and trading partner analytics with comprehensive reporting capabilities.

Compliance Network Dashboard

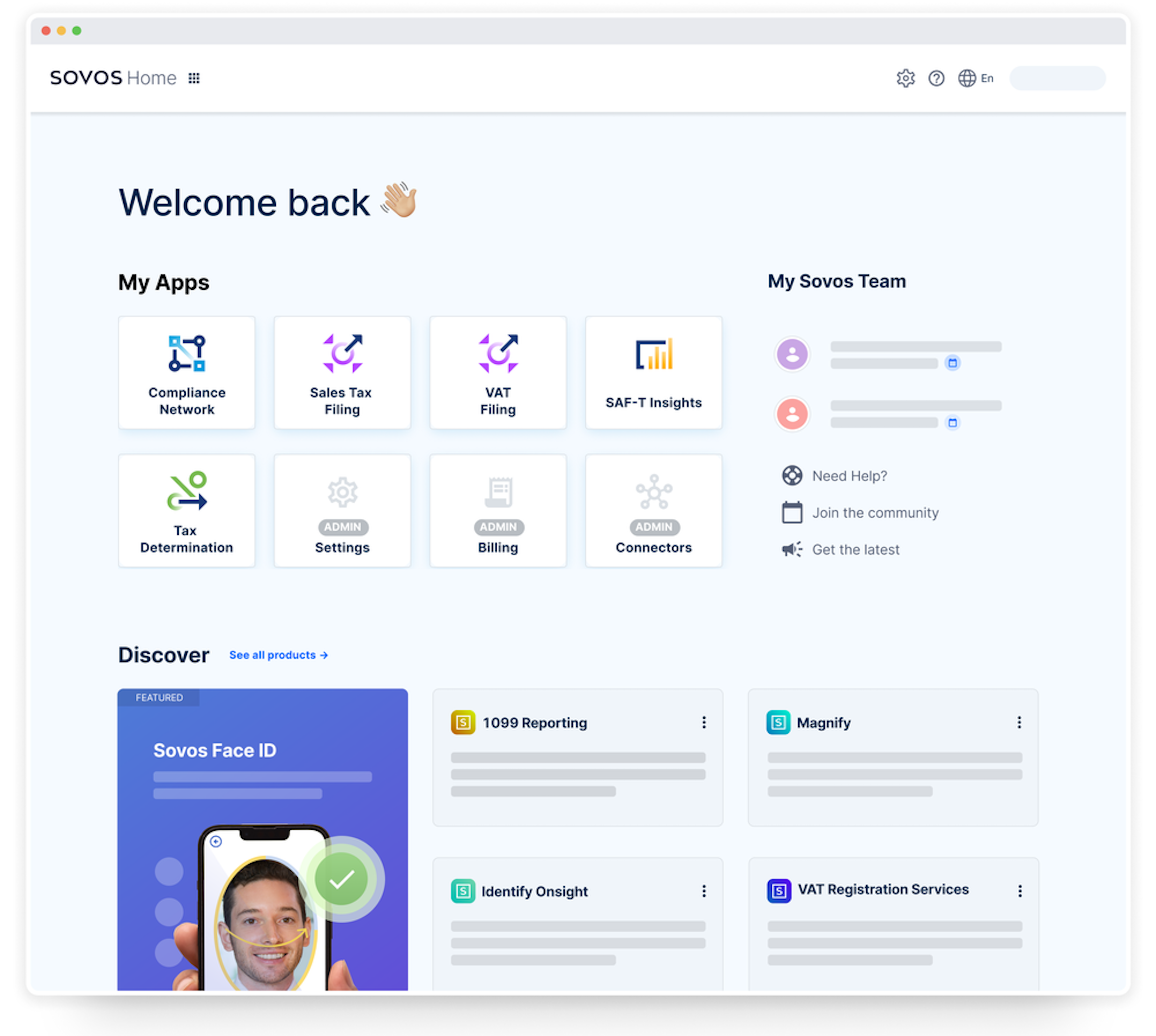

Sovos Compliance Cloud Dashboard

Compliance Network Invoice Lifecycle View

Compliance Network eArchive Search

Sovos Compliance Network provides end-to-end automation for global e-invoicing and Continuous Transaction Controls (CTC) compliance across 65+ jurisdictions. Designed to support B2B, B2G, and B2C requirements, the solution ensures invoices are validated, formatted, and submitted according to each countries VAT, GST, and real-time reporting mandates. With continuous regulatory updates, Sovos helps organizations stay aligned with evolving tax legislation and avoid penalties or rejection risks.

Through seamless integration with SAP ECC, SAP S/4HANA, Oracle, and other ERP or financial systems, Sovos enables organizations to generate, route, and submit compliant invoices without costly customizations or disruption to existing processes. Invoice orchestration ensures each document is delivered to the correct tax authority or e-invoicing network in the required structure and format, while multi-channel connectivity supports diverse global models.

Sovos Compliance Network centralizes invoice validation, government clearance, error management, and audit history within a unified platform. Real-time dashboards provide visibility into invoice statuses and compliance exceptions, and secure e-archiving ensures long-term storage and retrieval that meets global regulatory standards. Built for scale, Sovos supports high-volume transaction processing and adapts easily as new countries or mandates are added, helping businesses achieve continuous, reliable e-invoicing compliance as they expand.

Highlights

- Automated Global e-Invoicing Compliance: Supports B2B, B2G, and B2C e-invoicing with automated validation, country-specific formatting, and compliant submission across 65+ jurisdictions.

- Seamless ERP Integration: Integrates natively with SAP ECC, SAP S/4HANA, Oracle, and other ERP platforms to automate e-invoice generation, routing, and real-time CTC reporting without extensive customizations.

- Real-Time Compliance & Secure Archiving: Monitors evolving mandates, provides real-time visibility into invoice statuses and errors, and delivers compliant e-archiving with audit trails for long-term regulatory adherence.

Details

Introducing multi-product solutions

You can now purchase comprehensive solutions tailored to use cases and industries.

Features and programs

Financing for AWS Marketplace purchases

Pricing

Dimension | Description | Cost/12 months |

|---|---|---|

Compliance Network Subscription | Annual subscription for the Sovos Compliance Network in a selected territory. Requires the purchase of a transaction volume tier. | $5,000.00 |

Annual Transaction Volume | Enables transaction processing for Sovos Compliance Network. Pricing varies by volume; the listed price reflects the starting tier for up to 12,000 transactions annually. | $7,000.00 |

Additional Tax ID | Extend Compliance Network coverage with additional tax IDs. Pricing varies by quantity; the listed price reflects the starting tier for up to 5 tax IDs. | $1,000.00 |

Long Term Archiving | Supports long term digital storage of Compliance Network transactions. Pricing varies by transaction volume; the listed price reflects the starting tier calculated at 10% of annual transactions. | $700.00 |

Source System Connection | Annual license for integration with a single source system. | $5,000.00 |

Vendor refund policy

Payments for Sovos Compliance Network products are non-refundable unless otherwise specified in the applicable order or agreement.

Custom pricing options

How can we make this page better?

Legal

Vendor terms and conditions

Content disclaimer

Delivery details

Software as a Service (SaaS)

SaaS delivers cloud-based software applications directly to customers over the internet. You can access these applications through a subscription model. You will pay recurring monthly usage fees through your AWS bill, while AWS handles deployment and infrastructure management, ensuring scalability, reliability, and seamless integration with other AWS services.

Resources

Vendor resources

Support

Vendor support

Sovos is dedicated to providing exceptional service to each of our customers. Our commitment has earned Sovos recognition as a trusted, long-term partner rather than just a software provider. To ensure top-tier support, our teams specialize in specific solutions, offering expertise tailored to your needs. https://sovos.com/support/

AWS infrastructure support

AWS Support is a one-on-one, fast-response support channel that is staffed 24x7x365 with experienced and technical support engineers. The service helps customers of all sizes and technical abilities to successfully utilize the products and features provided by Amazon Web Services.

Similar products

Customer reviews

Easy-to-Use Website with Quick Sovos Support and Lifesaving 1099 Tutorials

Annual Use Made Easier with Clearer Guidance and a “Complete” Confirmation

2) your "womb to tomb" handling of the 1099 process

2) I think the system should be more user friendly and walk us thru the process (remember, we only use the software once a year.

3) I think there should be some banner or fanfare when the process is done. Even Turbotax offers a visual "complete" cartoon