Inflectra Solution for Finance, Banking and Insurance - Software Development and Testing Tools to Reduce Risk

InfoOverview

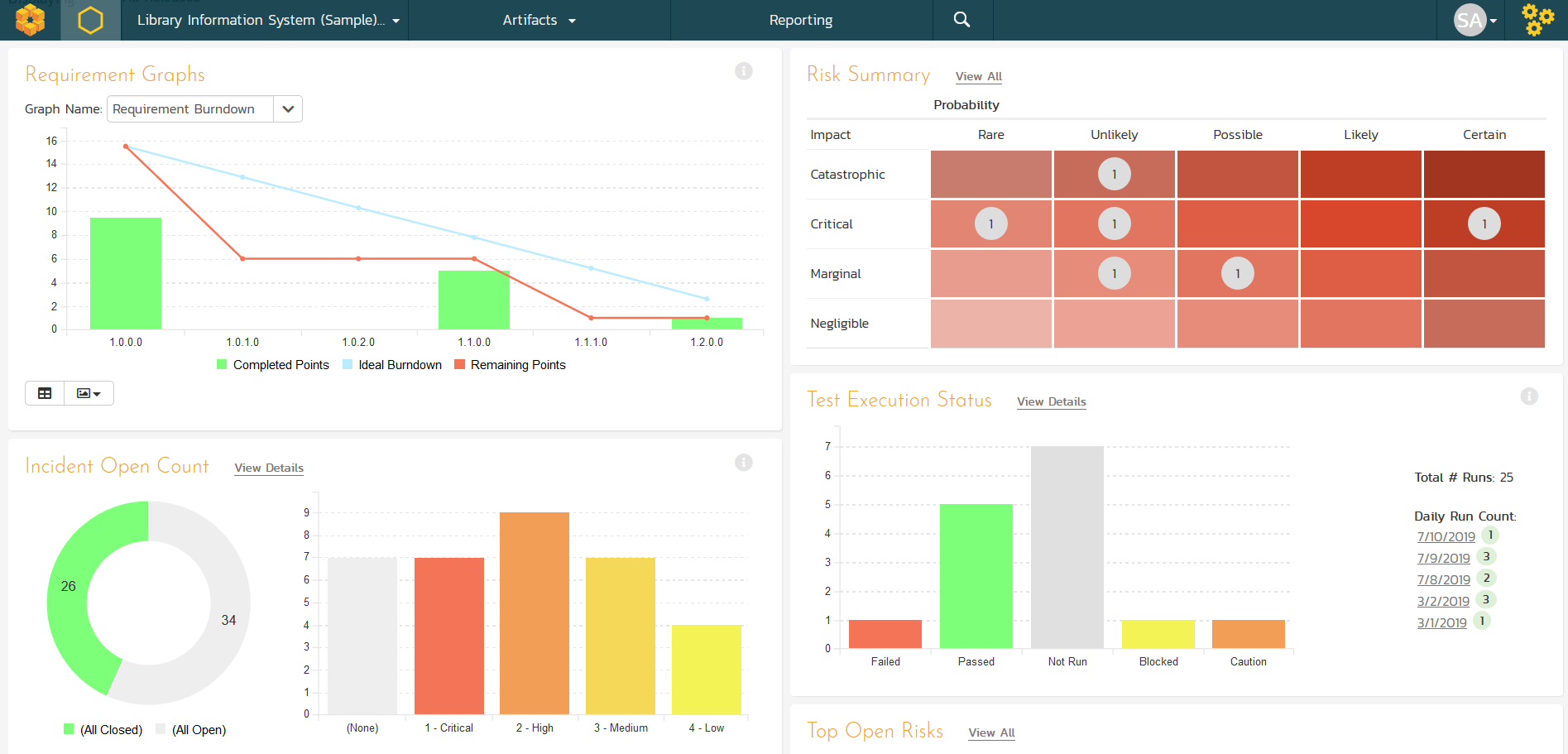

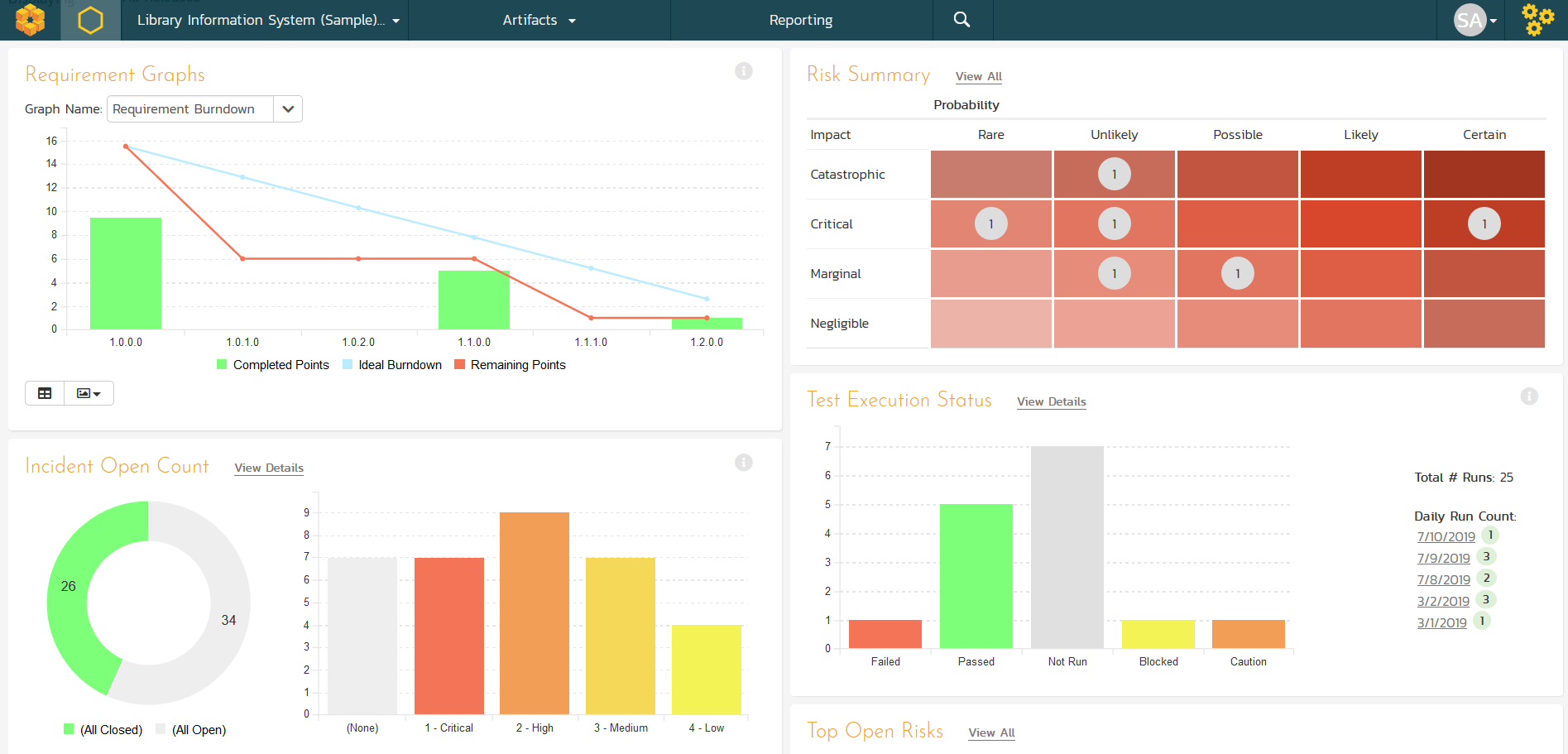

Integrated Dashbords of Key Software Metrics

SpiraPlan gives project and program managers a birds-eye view of all of their projects and programs in a single pane of glass, with all information in one place.

Integrated Dashbords of Key Software Metrics

Integrated Risk Management

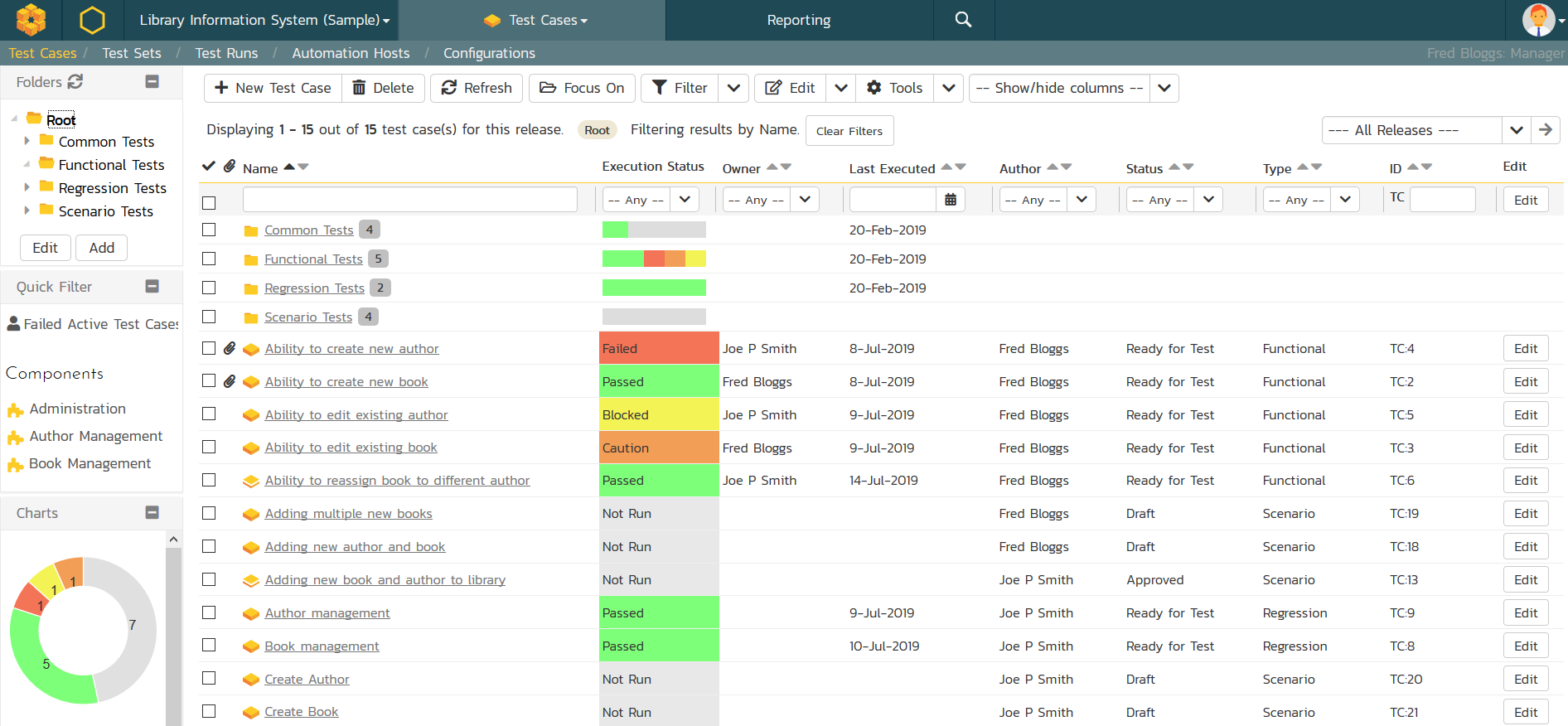

Test and Quality Management

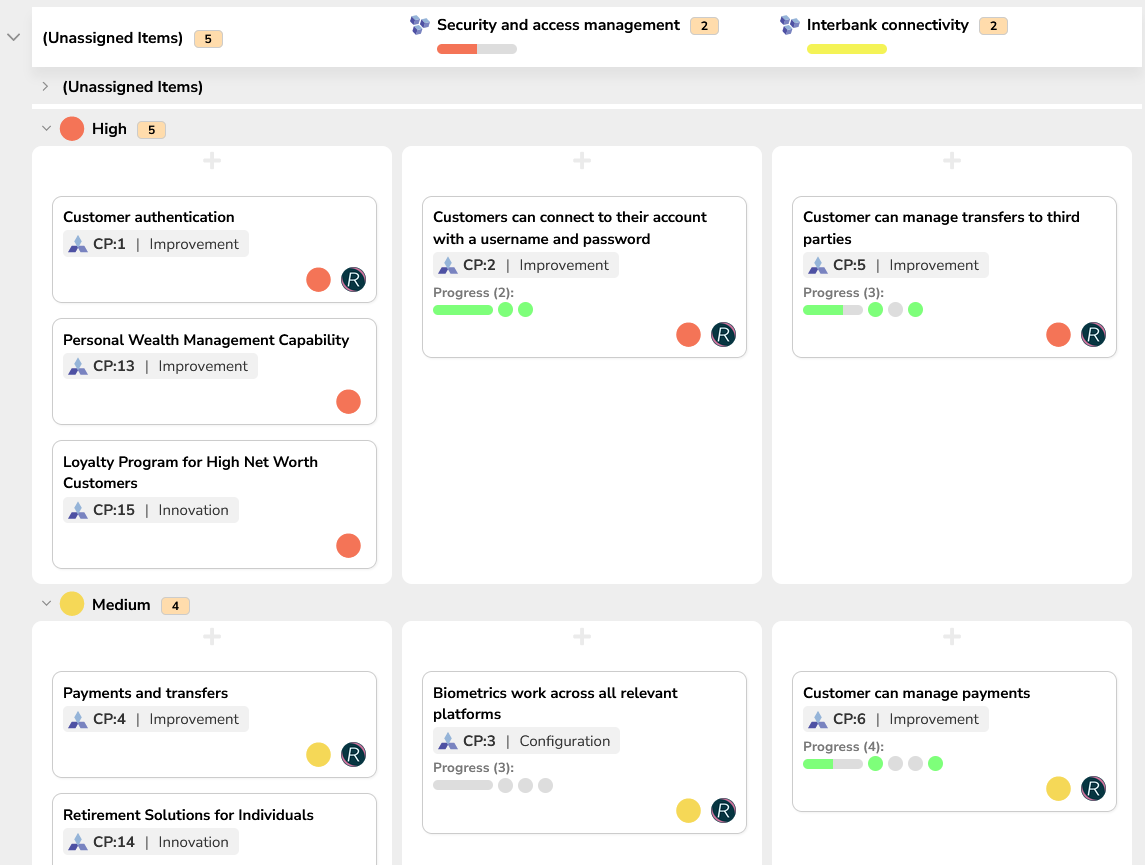

Program Backlog Planning

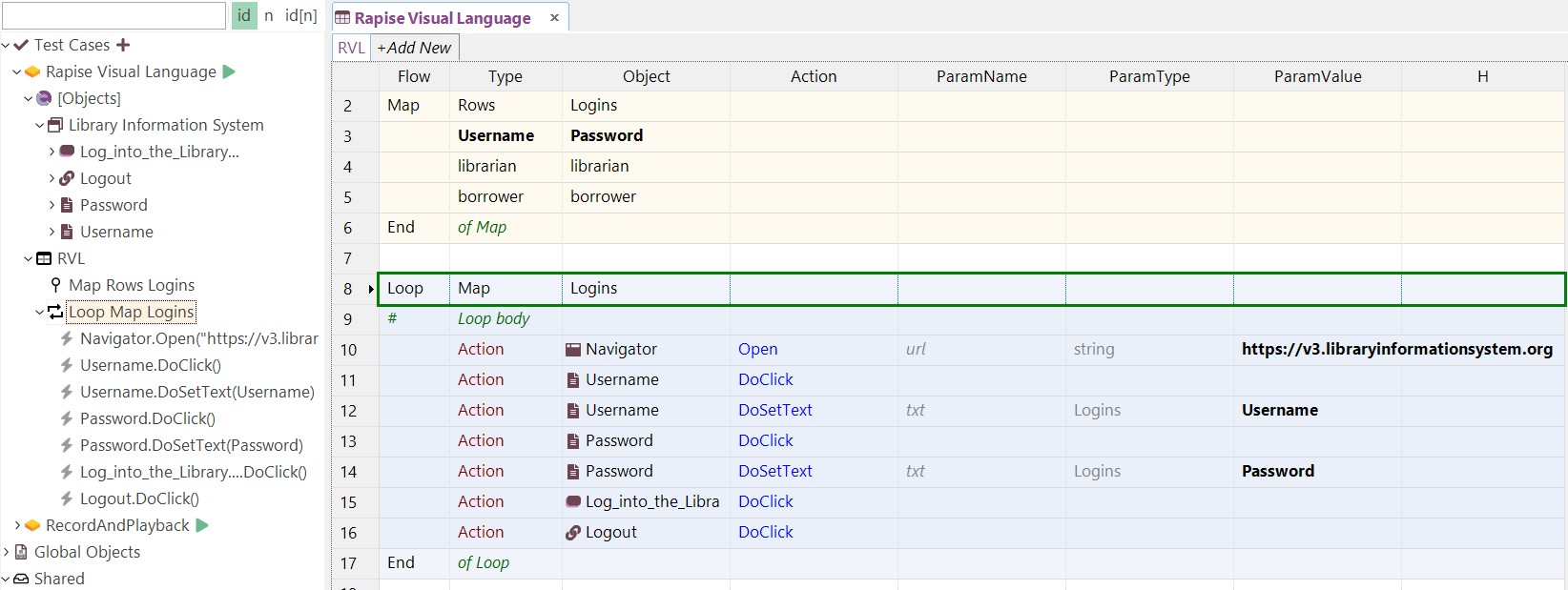

Automated Validation of Web, Mobile & Desktop Apps

Inflectra helps financial services organizations modernize and operate mission-critical systems by unifying requirements, testing, defects, risks, and release governance in a single platform with full traceability and audit trails. For banking, it supports core modernization and digital product delivery by coordinating complex dependencies across channels, APIs, data, and third-party integrations, while enforcing controlled change management, approvals, and measurable release readiness. For insurance, it accelerates cloud-based core platform transformations and ongoing configuration-heavy delivery by standardizing workflows and ensuring that every change is validated, traceable, and reportable across distributed teams and vendors. For capital markets, it strengthens delivery discipline for high-frequency releases and high-availability platforms by improving visibility into quality gates, regression scope, and production risk signals, enabling teams to respond faster without sacrificing control.

Across all three sectors, the platform improves operational resilience and compliance by centralizing evidence of what changed, why it changed, who approved it, and how it was tested. It reduces risk and cost by enabling automation at scale, connecting test execution and results to business and regulatory requirements, and providing real-time dashboards for leadership, technology, and risk stakeholders. The outcome is faster, more predictable delivery with stronger governance—supporting security, regulatory expectations, and customer trust while organizations evolve their architectures and digital capabilities.

Use cases

Cloud-Based Core Systems

The Inflectra suite helps insurers modernize cloud-based core systems by governing requirements, releases, and cross-team delivery with end-to-end traceability across configuration, integrations, testing, and defects. With Rapise automation and centralized reporting in Spira, teams validate frequent changes faster, reduce production risk, and demonstrate control and auditability for regulated operations.

Core Banking System Modernization

The Inflectra suite helps banks modernize core systems by governing complex transformation programs—tracking requirements, dependencies, risks, defects, and release readiness with end-to-end traceability across legacy and new platforms. With Rapise automation and centralized quality reporting in Spira, teams accelerate regression testing, strengthen change control, and reduce operational and regulatory risk while delivering faster, safer releases.

Digital Bank Launch

The Inflectra suite helps banks launch digital banks by coordinating requirements, releases, and cross-functional delivery (channels, APIs, KYC/AML, payments, and integrations) with governed traceability and audit trails. With Rapise-driven automation and centralized testing/defect management in Spira, teams validate rapidly, enforce quality gates, and go live faster with reduced security and regulatory risk.

Details

Introducing multi-product solutions

You can now purchase comprehensive solutions tailored to use cases and industries.

Products included

Features and programs

Financing for AWS Marketplace purchases

Pricing

Custom pricing options

Integration guide

SpiraPlan helps financial services teams govern complex, regulated delivery by managing requirements, risks, defects, and releases with full traceability, approvals, and audit trails across multiple systems and vendors. Rapise accelerates validation by automating functional and regression testing and feeding execution evidence back into SpiraPlan, so every change can be tied to controls, requirements, and release readiness. Together, they reduce change risk and compliance effort while enabling faster, more predictable releases for core banking/insurance platforms, digital channels, and capital markets systems.

How can we make this page better?