Overview

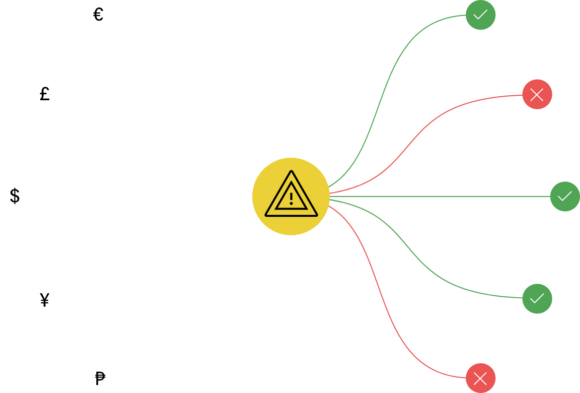

Compliance without frustration. Our payment screening solution delivers robust AML and sanctions protection without ever interrupting the customer journey. Real-time analysis and actionable signals help you confidently process payments.

- Higher straight-through processing without compromising on risk

- Reduce false positives powerful matching algorithms

- Boost sanctions compliance with real-time data

- Improve efficiency with integrated data, screening, case management and reporting

We source our data directly from regulators using advanced NLP technology tagged as best-in-class by Chartis in 2022. Over 100 partners already trust our global coverage and industry validated datasets.

Our advanced technology directly monitors regulators for updates, no more waiting for regulatory notices.

Highlights

- Screening as fast as 150 to 500 milliseconds supports any faster payment scheme (including Instant SEPA Credit, Faster Payments, and FedNow.)

- Work more efficiently with a flexible workflow. Keep tabs on alert queue statuses with an out-of-the-box dashboards.

- Seamless integration with our JSON REST API Out-of-the-box integration with several core banking platforms.

Details

Introducing multi-product solutions

You can now purchase comprehensive solutions tailored to use cases and industries.

Features and programs

Financing for AWS Marketplace purchases

Pricing

Dimension | Description | Cost/12 months |

|---|---|---|

30k Annual Transactions | Screening transaction against sanctions and PEP database | $30,000.00 |

Vendor refund policy

No refunds

How can we make this page better?

Legal

Vendor terms and conditions

Content disclaimer

Delivery details

Software as a Service (SaaS)

SaaS delivers cloud-based software applications directly to customers over the internet. You can access these applications through a subscription model. You will pay recurring monthly usage fees through your AWS bill, while AWS handles deployment and infrastructure management, ensuring scalability, reliability, and seamless integration with other AWS services.

Resources

Vendor resources

Support

Vendor support

AWS infrastructure support

AWS Support is a one-on-one, fast-response support channel that is staffed 24x7x365 with experienced and technical support engineers. The service helps customers of all sizes and technical abilities to successfully utilize the products and features provided by Amazon Web Services.

Similar products

Customer reviews

Cost-Effective and Easy to Use for Startups

We no longer have to struggle with manual screening of our customers.